Incoterms are essentially terms between buyers and sellers. These terms dictate what responsibilities the buyer and seller are responsible for during a transaction. This includes determining who pays for the insurance, who is responsible for paying for the carrier to transport the goods, and who will cover the costs for related import duties and fees. The International Chamber of Commerce (ICC) created Incoterms as a way to help facilitate healthy global trade between nations. Therefore, Incoterms are internationally accepted by every country.

Types of INCO Terms

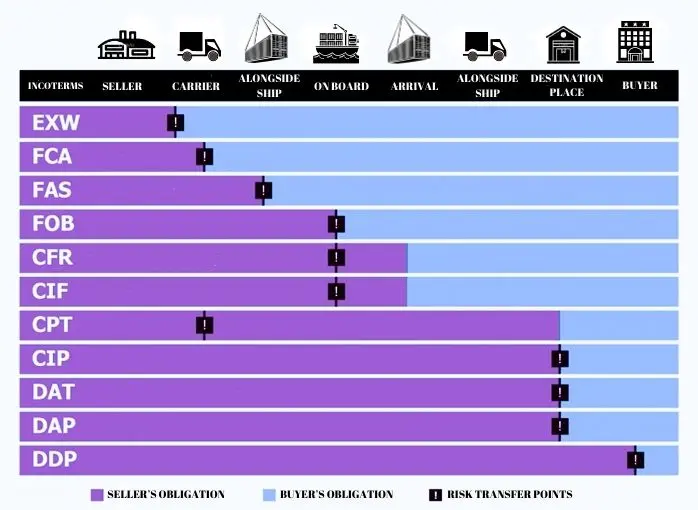

There are 11 distinct Incoterms® defined in the 2010 edition, which serve as standardized rules for international trade. These terms clarify the responsibilities of buyers and sellers in transactions involving the shipment of goods across borders. Among these, seven Incoterms can be applied to any mode of transportation, while four are specifically designated for maritime transport. Understanding these terms is crucial for businesses engaged in international trade, as they dictate who bears the costs and risks at various stages of the shipping process. Below is a detailed overview of the 11 types of Incoterms® and the conditions associated with each.

EXW

The Ex Works (EXW) term is one of the most seller-friendly Incoterms. Under this arrangement, the seller's responsibility is minimal; they are only required to make the goods available for pickup at their premises or another specified location. All costs and risks associated with the shipment, including transportation, insurance, and customs clearance, fall entirely on the buyer. This means that the buyer must handle everything from loading the goods to delivering them to their final destination.

FCA- Free Carrier

Similar to EXW, the Free Carrier (FCA) term also favors the seller. Here, the seller is responsible for delivering the goods to a carrier designated by the buyer at a specified location. Once the goods are handed over to the carrier, the buyer assumes responsibility for all subsequent costs and risks associated with the shipment. This term is often used when the seller has to arrange for transportation to a nearby terminal or loading point.

CPT- Carriage Paid to

Under the Carriage Paid To (CPT) terms, the seller takes on more responsibility than in EXW and FCA. The seller pays for the transportation of goods to a specified destination, but the risk transfers to the buyer once the goods are loaded onto the transport vehicle at the origin. This means that while the seller covers the shipping costs, the buyer assumes the risk of loss or damage during transit.

CIP- Carriage and Insurance Paid to

The Carriage and Insurance Paid To (CIP) term is similar to CPT, with the key difference being that the seller is also responsible for obtaining insurance for the goods during transit. While the seller covers the transportation costs and insurance, the risk transfers to the buyer once the goods are loaded at the origin. This term provides an added layer of protection for the buyer, as they can be assured that the goods are insured during transport.

DPU- Delivered At Place Unloaded

Previously known as Delivered At Terminal (DAT), the Delivered At Place Unloaded (DPU) term places the maximum responsibility on the seller. The seller is tasked with delivering the goods to a specified destination and is responsible for unloading them. The seller assumes all risks and costs until the goods are unloaded at the buyer's location, making this term very advantageous for buyers.

DAP- Delivered At Place

The Delivered At Place (DAP) term is more favorable to the buyer. Under this arrangement, the seller is responsible for delivering the goods to a specified destination, including all costs and risks involved in the shipment. The buyer is only responsible for unloading the goods upon arrival. This term is particularly useful when the buyer wants to minimize their responsibilities and risks throughout the shipping process.

DDP- Delivered Duty Paid

The Delivered Duty Paid (DDP) term represents the highest level of seller responsibility. In this scenario, the seller is responsible for delivering the goods to the buyer's specified location, covering all costs, including transportation, insurance, and import duties. The seller assumes all risks until the goods are delivered, making it a highly favorable term for buyers who want a hassle-free transaction.

The 4 types below are applicable specifically for shipments via ship:

FAS- Free Alongside Ship

The Free Alongside Ship (FAS) term is specifically used for maritime transport. Under this arrangement, the seller is responsible for delivering the goods alongside the vessel nominated by the buyer at the port of shipment. Once the goods are placed alongside the ship, the risk and responsibility transfer to the buyer, who must then load the goods onto the vessel.

FOB- Free On Board

The Free On Board (FOB) term is similar to FAS but includes the loading of goods onto the ship. The seller is responsible for all costs and risks until the goods are loaded onto the vessel at the port of departure. Once the goods are on board, the buyer assumes responsibility for the shipment, including any risks associated with the transport.

CFR- Cost and Freight

Under the Cost and Freight (CFR) terms, the seller covers the costs of transporting the goods to the destination port. However, the risk transfers to the buyer once the goods are loaded onto the vessel. This means that while the seller is responsible for shipping costs, the buyer must bear the risk of loss or damage during transit.

CIF- Cost, Insurance, and Freight

The Cost, Insurance, and Freight (CIF) term is similar to CFR, with the added requirement that the seller must also obtain insurance for the goods during transport. The seller covers the shipping costs and insurance, but the risk transfers to the buyer once the goods are loaded onto the vessel. This term provides additional security for the buyer, ensuring that the goods are insured during their journey.

As you can see, each set of terms is unique in its own way. Being aware of the specifics for each one should help guide you to selecting the right terms for your specific shipments.

The Three Most Common Incoterms for Sourcing from China:

Generally speaking, the three incoterms that offer the most viable options when importing goods from China are FOB, EXW, and CIF.

1. Sourcing from China Under the FOB Incoterm

Your Responsibilities With FOB:

- Ocean freight costs and surcharges

- Ocean freight insurance

- Arrival fees

- Customs clearance

- Inland transportation costs from the port of arrival to the destination

- All associated taxes and tariffs

Your Seller’s Responsibilities With FOB:

- Inland transportation from the warehouse in China to your chosen port of loading

- Provision of certificates required at the port of loading

- Management of customs clearance in China

- Customs fees in China

- Port expenses

2. Sourcing from China Under the EXW Incoterm

Your Responsibilities With EXW:

- Paying for the cargo

- Ensuring the cargo

- Departure fees

- Arrival fees

- Customs clearance at origin to destination

- Inland transportation at origin and destination

- All associated fees and duties

Your Seller’s Responsibilities With EXW:

- Making the goods available for transportation

- Provision of all certifications and documents ready for export

3. Sourcing from China Under the CIF Incoterm

Your Responsibilities With CIF:

- Pay for the cargo

- Arrival fees

- Customs clearance at the destination

- Port to warehouse transport fees

- Import taxes

Your Seller’s Responsibilities With CIF:

- Delivery of goods as agreed

- Management of export documentation

- Warehouse to port transportation costs in China

- Charges at the port of origin

- Customs clearance in China

- Customs fees in China

- Ocean freight costs

- Insurance costs

Understanding Incoterms® and the Importance of Negotiation

A clear understanding of Incoterms® is essential for smooth trade with Chinese suppliers. These internationally recognized rules outline the responsibilities of both buyers and sellers in international transactions, covering aspects like transportation, insurance, customs clearance, and costs. By carefully selecting the appropriate Incoterm and engaging in open negotiations with your supplier, you can mitigate risks, allocate responsibilities effectively, and avoid misunderstandings. We're here to assist you in navigating these complexities and ensuring a seamless trade process.

Conclusion: INCO Terms China

INCO Terms China

In conclusion, Incoterms are essential for facilitating smooth international trade by clearly defining the responsibilities and obligations of buyers and sellers throughout the shipping process. Established by the International Chamber of Commerce (ICC), these standardized rules provide a common framework that helps prevent misunderstandings and disputes in cross-border transactions. The 11 distinct Incoterms outlined in the 2010 edition categorize responsibilities based on various transportation modes, ensuring that all parties involved understand their roles and the associated risks.

Understanding the nuances of each Incoterm is crucial for businesses engaged in global trade, as the terms range from seller-friendly arrangements like Ex Works (EXW) to more buyer-friendly terms like Delivered Duty Paid (DDP). The choice of Incoterms can significantly impact the overall cost structure of a transaction, influencing logistics, insurance, and customs clearance processes. By selecting the appropriate Incoterm and engaging in open negotiations with suppliers, companies can mitigate risks, allocate responsibilities effectively, and ensure smoother transactions, thereby fostering healthy global trade relationships.

.